Service Details

- Home

- Services

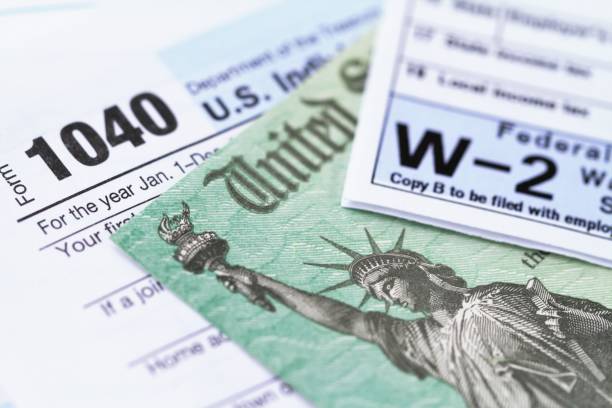

Tax Filing is a mandatory financial contribution imposed by the government on individuals and businesses, calculated as a percentage of their earnings. It serves as a crucial revenue source to fund public services and infrastructure. Taxable income encompasses various sources, including salaries, investments, and self-employment earnings. Individuals often file annual tax returns, providing details of their income, deductions, and exemptions. Tax codes and rates vary across jurisdictions, influencing the overall tax liability. Effective tax planning helps individuals optimize their financial affairs while staying compliant with the law.

For more information visit IRS